Table of Content

Copy of salary certificate duly attested by Indian Embassy / Consulate / SBI Branch / Exchange Companies abroad recognized by SBI. No prepayment penalty if loan is closed after half the original tenor. I declare that the information I have provided is accurate & complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affiliates to call, email, send a text through the Short messaging Service and/or Whatsapp me in relation to any of their products. The consent herein shall override any registration for DNC/NDNC.

Most banks require a Power of Attorney to ease the process of dealing with the NRI customer. The POA holder only gets the powers that you give and does not have the power of dealing with the property. Also, if you want to pre-close the home loan a pre-payment penalty will be charged by the bank.

Tax Benefits of NRI Home Loans

For a smooth transaction and a hassle-free ownership experience, make sure you check and verify all the essential papers. Payments are often made through NRO, NRE, NRNR, and FCNR accounts. These permitted accounts could alter in accordance with RBI rules. On the other hand, if the home is on rent, one can claim the complete interest payable component as a tax deduction on their home loan.

However, while applying for a home loan, a new Power of Attorney has to be mandatorily created since the lenders have their own prescribed formats for power of attorney defining the rights for a loan to the holder. If the applicant is in India during the loan application process and disbursement, he can get it notarised from the court. In case he is abroad, the power of attorney has to be notarized from the Indian Embassy or consulate.

HDFC Ltd Home Loan Pollachi | Interest Rates 2022 | Branch Address

When to apply for an NRI Home Loan – An NRI can apply for a Home Loan even before making the final decision about the property. You can get a loan pre-sanctioned based on the repayment capacity. NRIs and PIOs, who are eligible for these loans, are people of Indian birth, descent or origin who are settled out of India. Bank account details for the previous 6 months overseas account showing salary and savings and Indian account if any. SBI NRI Home Loan allows many NRIs to get home loans when investing in properties.

Nowadays many banks have stopped charging pre-payment on floating-rate loans. The EMI payment also should be from any valid deposit account maintained in India including Non-Resident Ordinary accounts. This can also be from the rental income derived from the property.

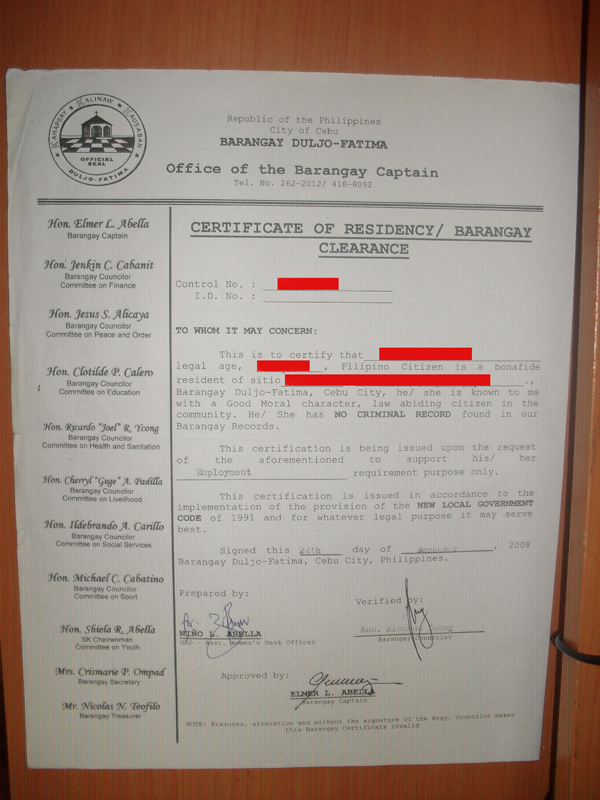

Document checklist for NRIs buying property in India

Employment Contract – A copy of the latest employment contract is required. The employment contract also is required to be attested by the employer. Valid Work Permit – All Non-Resident Indian’s and PIO’s have to provide a valid work permit of the country they are working in.

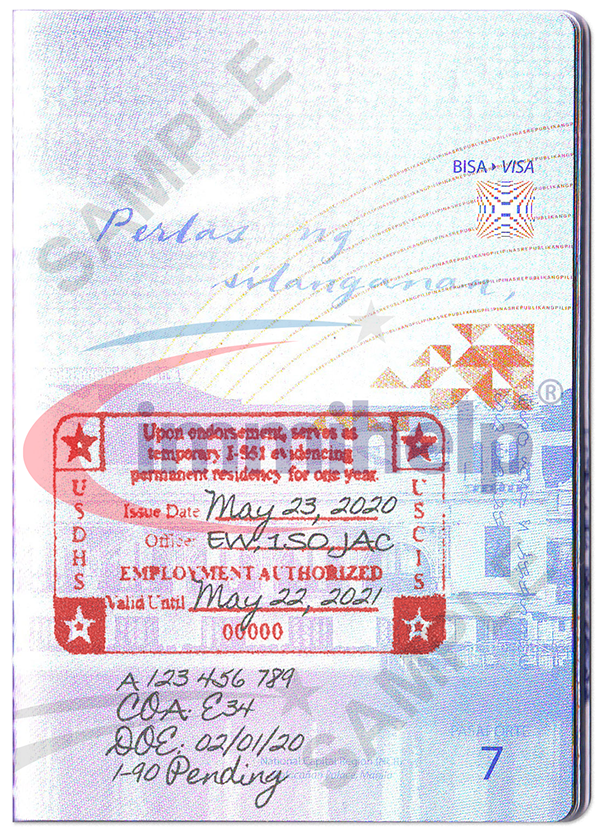

Copy of the valid resident Visa stamped on the passport. Account statements of the individual’s NRO/NRE account in India for the last 6 months. Other Documents Copy of the valid resident Visa stamped on the passport. Title deeds of the property along with the previous chain of documents. Bank Statements of the applicant’s Non-Resident External /Non-Resident Ordinary account in India for the last 6 months.

Generally, Experian is the credit history provider in most of the countries, you can refer to the list of credit bureau agencies for further details. Applicants working in Singapore also have to provide an income tax certificate. Singaporeans are also required to provide CPF account transaction for the last six months. For the duration of the loan, the housing loan must be paid in full upfront through direct remittances from abroad, either through regular banking channels or from other financial accounts that the RBI may approve. NRIs can avail of tax benefits on home loans by filing the income tax return in India under Section 139 of the Income Tax Act, 1961. However, most banks offer loans for a tenure of up to 30 years.

Copy of Visa – A valid Visa either stamped on a Passport or on paper needs to be provided to the financial institution. NRIs (Non-resident Indians) or PIOs are the key segments in the residential property consumers. Always use the customer care numbers displayed on Bank’s official website. Click below to download the list of documents mentioned above.

The loan-to-value ratio for NRI customers varies from one bank to another, though the manner of calculation is the same in the case of a regular home loan. An English translation of the contract duly attested by employer / consulate / SBIs foreign branches / offices, or Embassy in case the contract is available in any other language. Concessions on charges for personal remittances and outstation cheques.

Yes, the bank required the property in question to be insured properly against hazards such as fire, floods, etc. during the loan tenure. While insuring the property, you will be required to make HDFC the beneficiary of the policy. You will all be required to provide the bank with evidence on an annual basis or as requested. For purchase of flat- construction agreement, allotment letter, copy of approved plan, estimates-payment schedule, undertaking from the builder in Form B format as specified by the bank. Unique opportunity to avail mortgage loans, student loans with minimum formalities on maintaining a good repayment record.

MagicBricks.com is India's No 1 Property portal and has been adjudged as the most preferred property site in India, by independent surveys. The portal provides a platform for property buyers and sellers to locate properties of interest and source information on the real estate space in a transparent and unambiguous manner. The bank issues a loan in the favour of the builder/seller through a cheque. In case of ready to move property, the bank issues the entire amount in one go, whereas in under-construction projects the amount is disbursed in phases according to the level of completion. Highest Qualification Proof – Highest educational qualification proof is a mandatory document by leading lenders in case of NRIs to understand the growth prospects of the applicant and his income. Address Proof – Proof of address needs to be provided for the residence customer is residing overseas.

Please note Co-applicant’s income can be considered for enhancing loan eligibility. Interest rates – One can opt to apply for a Home Loan with floating or fixed interest rates. Fixed interest rates imply that the interest rate will remain the same for the entire loan tenure. On the other hand, floating interest rates indicate that the interest rate will be reset at periodic intervals, as and when the benchmark interest rate changes.

It is available for those who have a minimum 12 months of regular repayment of their home loan. The maximum repayment tenure is 30 years or till the retirement age, whichever is sooner. They have hidden quite a number of things - e.g., whenever i gave a cheque in London office for prepayment, they send the cheque to India and only the date when they receive the cheque in India is considered as payment date. For one of my prepayment, they took almost 10 days against their SLA of 5 days.

I wouldn't recommend thinking of HDFC when you avail NRI loans. Actually, it is always recommended to make a joint application. It will help reduce the burden of interest on your shoulders.

No comments:

Post a Comment