Table of Content

This is available for both self-employed and salaried individuals. The maximum loan repayment tenure for this plot loan is 15 years. HDFC's Home Extension Loans can be availed by both new and existing NRI customers of the bank. This can be used to extend the house or add additional rooms to a house.

Along with the Overseas account, the applicant also needs to provide statements of six months for all the bank account held in India. NRI Home Loans are available with lowest interest rate starting from 6.85% p.a. You can take an NRI housing loan for a wide range of housing needs which includes purchase of flat/house/plot, construction and towards costs of renovating/repair of an existing home. The income taken into account for calculating the home loan eligibility for an NRI is the repatriable income, plus any income in India.

Repayment Period

Are you considering buying a new home in India with a mortgage? Our application process is seamless and entirely online. You can even use our home loan EMI and eligibility calculators to plan better! Many NRIs buy property in India for various reasons - as a long-term investment; as a place to stay during their visits home; as a way to remain emotionally connected to India or for their families back home. Once you embark on the process, you will realize that buying real estate in India requires you to complete a few formalities and documentation. Here’s a quick checklist of what you will need at every stage.

The HDFC House Renovation Loan can be availed by improving or renovating homes situated in India that belong to new and existing NRI customers of the bank. This can include home improvement work such as painting, flooring, tiling, plastering, etc. Additional security by way of lien over credit balances in deposit accounts, NSCs, life insurance policies, third party guarantees, if security is either inadequate or not free from encumbrances. For Purchase / construction of house-Original title deed, non-encumbrance certificate on the property for 13 years, possession certificate and land tax receipt. Account statement / passbook of overseas bank showing salary and savings.

Loans for NRI - Key Benefits & Features

Copy of identity card issued by the current employer / proof of income in case of self employed professionals / businessmen. The cheque for the loan amount is drawn in favour of the builder or seller as the case may be. In the case of an under-construction property, ICICI Bank disburses loan amounts appropriate to the state of construction.

Both salaried and self-employed individuals can apply for the loan. The maximum funding is up to 90% of the property value. The maximum repayment term is 20 years although this can be on the discretion of the bank based on the customer's profile.

CMS and Payment Solution

You can apply for anIndia Home Loaneven before you have selected your property. ICICI Bank will sanction a loan amount, based on your repayment capacity. Further, the amounts must be settled in Indian Rupees only.

Financially, it makes sense to purchase a property through home loan rather than through personal financing especially when you can invest your personal funds somewhere else for better returns. By clicking "Proceed" button, you will be redirected to the resources located on servers maintained and operated by third parties. SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site.

Income Documents

With IIFL Home Loans not only are you assured of faster processing of your loan application but also enjoy a hassle free experience. Yes, self-employed NRIs can also get home loans if they can produce income statements for three years. The maximum amount of the home loan will depend on the factors like NRI’s age, income and property value. However, banks cannot grant fresh loans or renew existing loans in excess of Rupees 20 lakh against NRE and FCNR deposits either to the depositors or to third parties.

A Person of Indian Origin is an individual with an Indian passport who is not a citizen of China, Iran, Nepal, Bangladesh, Pakistan, Sri Lanka, or Bhutan but has ever held an Indian passport. Or one who, in accordance with the Indian Constitution or the Citizenship Act of 1955, had either/both of their parents or grandparents who were Indian citizens. If the home has been rented out, then the entire interest payable component can be claimed as a tax deduction on your home loan. 2) Appointment Letter / Contract Letter Copy / salary certificate clearly mentioning the date of joining, designation in the company and current salary earned. With NRI Top Up Loan, get high value loans upto 50 Lakhs. Yes, NRI can also get a home loan with another co-applicant.

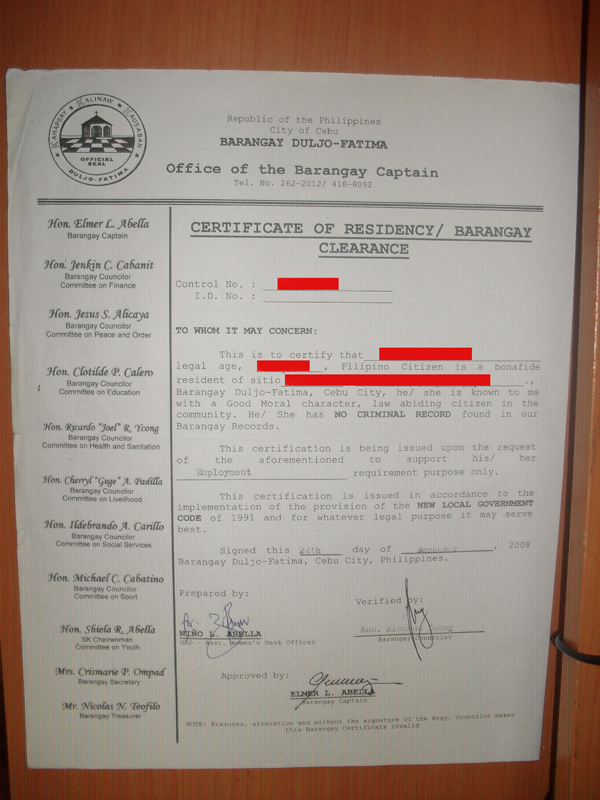

If the applicant is not in the country while putting up the applications, financial institutions may ask for a Notarised / attested copy of KYC from the Indian Embassy or consulate. PAN Card – All NRIs or PIOs have to provide a copy of the PAN Card for applying for the loan. It is a mandatory requirement for all co-borrowers. One can attain the status of being an NRI by staying overseas for more than 182 days.

Estimated cost of construction by a civil engineer or an architect. Provision to reschedule repayment obligations if you return to India. Valid Indian Passport / valid foreign passport (for People of Indian Origin – PIOs). Provision to add expected rent accruals, if the applicant proposes to let out house / flat.

Copy of salary certificate duly attested by Indian Embassy / Consulate / SBI Branch / Exchange Companies abroad recognized by SBI. No prepayment penalty if loan is closed after half the original tenor. I declare that the information I have provided is accurate & complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affiliates to call, email, send a text through the Short messaging Service and/or Whatsapp me in relation to any of their products. The consent herein shall override any registration for DNC/NDNC.

The conversion rate followed by the financial institutes is a weighted average converted rate derived fortnightly since due to fluctuation of rates, its difficult to evaluate daily conversion rates. Previous Employment details – If the current employment is less than two years, an experience letter from previous employers is required. Valid Labour Card / ID Card – Various countries provide Labour card / ID card to the people who are not resident of that country.

Offers

An NRI or PIO can also avail of a loan from an authorised dealer for acquiring a flat/house in India for his own residential use against the security of funds held in his NRE Fixed Deposit account or FCNR account. It is important that an NRI provides General Power of Attorney in favour of a local relative as per the draft of the bank which should be duly attested by the Indian consulate in the country of his residence. In case the loan borrower is in India, the POA can be locally notarized. Though the regular home loan tenures can be up to 25 years, loan tenure for NRIs is normally 15 to 20 years. Often this would be subject to the age of the borrower.

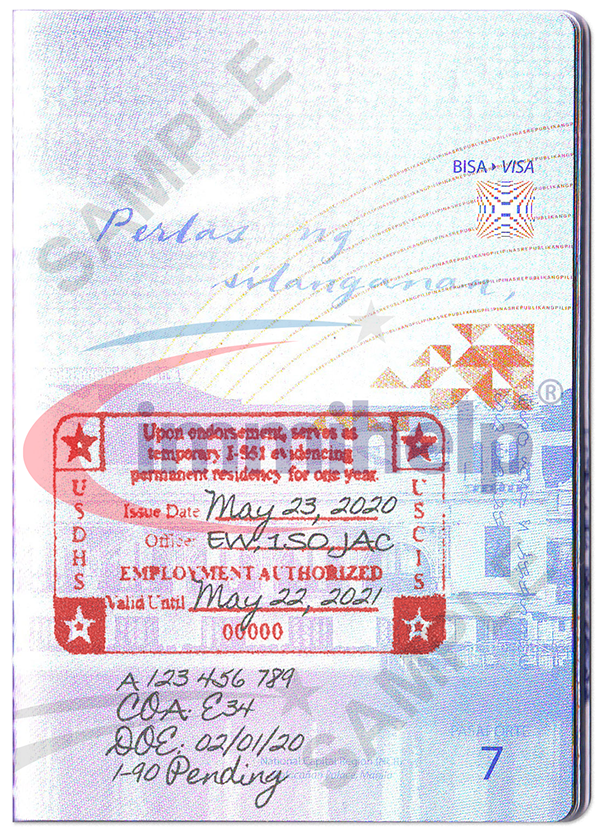

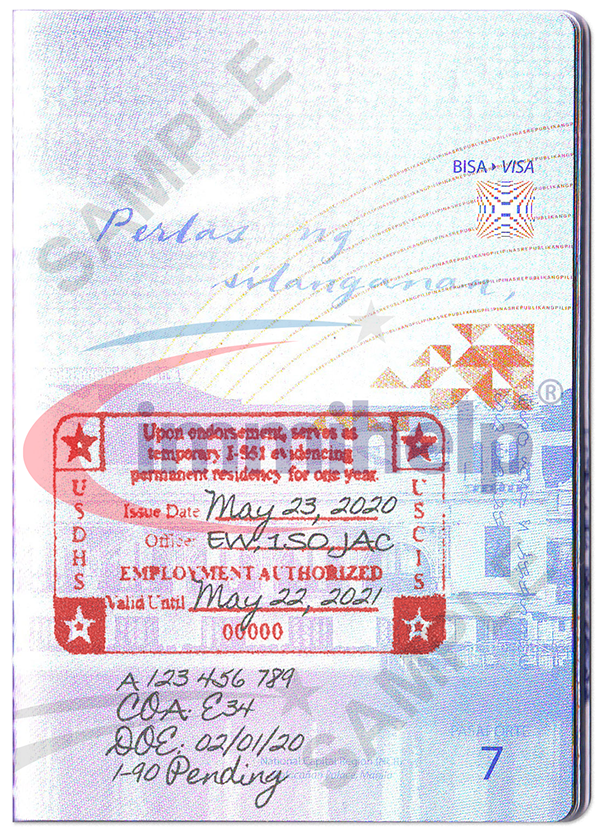

Copy of the valid resident Visa stamped on the passport. Account statements of the individual’s NRO/NRE account in India for the last 6 months. Other Documents Copy of the valid resident Visa stamped on the passport. Title deeds of the property along with the previous chain of documents. Bank Statements of the applicant’s Non-Resident External /Non-Resident Ordinary account in India for the last 6 months.

No comments:

Post a Comment